The year 2025 continues to showcase gold as an investment beacon that provides stability and prosperity to investors. Analysts predict that current elevated gold prices will stay strong because of geopolitical dangers alongside aggressive trade practices and could rise to $3,000 per ounce in upcoming months. Research shows the persistent value of gold as a dependable investment because prices continue to increase.

Why Invest in Gold in 2025?

The world has valued gold due to its fundamental worth and its protective qualities during economic uncertainty. Various conditions in 2025 create favorable circumstances for gold investment.

Economic Uncertainty: International financial markets witness increasing price instability because of rising international conflicts and changing international trading standards. Investors can obtain wealth protection through gold because it operates as a secure investment option.

Inflation Hedge: The upward movement of inflation reduces the actual buying power possessed by conventional monetary systems. Historically, gold preserves its market worth thus acting as protection when inflationary conditions appear.

Diversification: Professional investors add gold to their portfolios to minimize risks through their conflicting market behavior versus standard financial investments.

Ways to Invest in Gold

Investors have multiple avenues to gain exposure to gold:

Physical Gold: People who choose to purchase tangible gold forms through coins, bars, or jewelry hold physical possession of the asset. A physical ownership experience comes with this approach yet it demands secure storage spaces together with insurance coverage.

Gold ETFs and Mutual Funds: Exchange-traded funds (ETFs) together with mutual fund products that monitor the gold market offer investors the ability to participate in gold investment without requiring physical storage solutions. Financial instruments enable easy stock exchange trading by monitoring the gold price movement.

Investing in Gold Jewelry: A Blend of Aesthetics and Value

Gold jewelry functions in India as a prestigious piece for decoration but also serves investment purposes. The purchase of gold jewelry provides owners with decorative items that preserve the underlying value of this investment.

Gold Mining Stocks: Investors who support gold mining firms obtain secondary gold price coverage through their capital investment. Investing in these stock assets enhances gold price direction but investors need to manage risks that emerge from corporate performance alongside business operations.

Digital Gold: Investors can use modern digital platforms to buy and sell gold through electronic transactions because of technological progress. Digital transactions enable investors to obtain physical gold ownership benefits through electronic platforms.

Investors need to check the purity level together with craftsmanship quality and hallmark certification when buying gold jewelry to maintain its authenticity and preserve its value.

Battulaal Prayag Narayan Jewellers: A Legacy of Trust and Excellence

For those looking to invest in gold jewelry, Battulaal Jewellers stands as a beacon of quality and trust. Established in 1915, Battulaal has been adorning patrons with exquisite gold and silver jewelry, blending traditional craftsmanship with contemporary designs.

As the only jeweller in Uttarakhand offering Kumaoni and Garhwali gold jewellery with BIS Hallmark Certification, Battulaal ensures that each piece meets the highest standards of purity and authenticity.

Exploring Investment-Worthy Pieces

Battulaal's extensive collection caters to diverse tastes and investment preferences. Here are some standout pieces that combine aesthetic appeal with investment value:

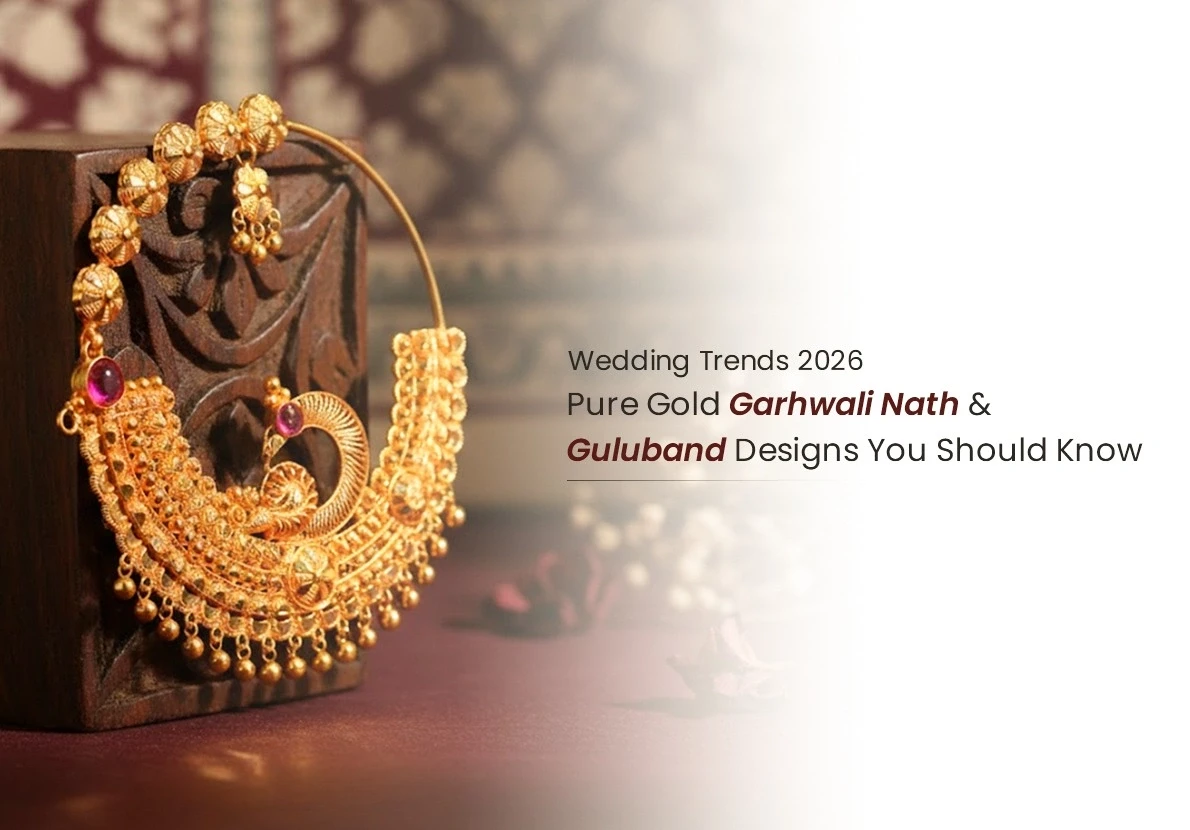

Gold Nath: This elegant pure gold garhwali nath showcases a harmonious blend of craftsmanship and modern design, making it a timeless addition to any collection.

Lavish 22 Karat Yellow Gold Beaded Mangalsutra: A traditional piece with intricate beadwork, this mangalsutra embodies cultural significance and purity.

Enchanting Diamond Necklace Set: Featuring exquisite garhwali guluband gold jewellery set exudes luxury and serves as a valuable investment.

By choosing such pieces, investors can enjoy the dual benefits of owning beautiful jewelry and securing their wealth in gold.

Tips for Investing in Gold Jewelry

To make informed decisions when investing in gold jewelry, consider the following:

Purity: Opt for pieces with higher karat ratings, such as 22K or 24K, to ensure maximum gold content.

Certification: Always purchase jewelry with proper hallmark certification to verify authenticity and purity.

Craftsmanship: Intricate designs may carry higher making charges. Balance aesthetic preferences with investment goals.

Resale Value: Classic designs often retain value better than trendy pieces. Consider the potential resale value when making a purchase.

Conclusion

Investing in gold in 2025 serves as a protection measure against economic uncertainties. Gold provides long-term value as a timeless investment available in either physical commodities, financial instruments or elaborate jewellery forms. Battulaal Jewellers serves as a reliable platform where investors can purchase valuable gold jewellery that combines traditional aesthetics with investment opportunities.

Investors can beneficially combine jewellery admirability with financial security through their strategic purchase of valuable pieces while keeping track of market developments.